Great retention tool

Since 1999, our one-of-a-kind program has paid employers more than $4.4 billion, boosting bottom lines and strengthening the Texas economy.

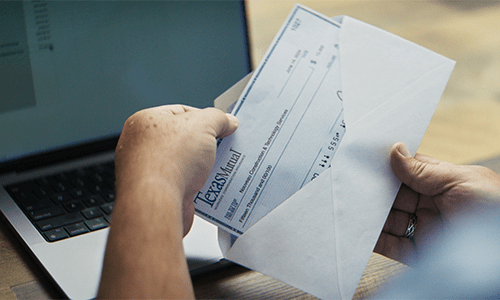

"It's really hard to take somebody away from Texas Mutual once they've tasted those dividends," explains Brad Board, an Insurica agent who's seen the difference a dividend can make. "You walk in with a check, and they see the envelope, and immediately they're smiling. They're like, ‘He’s bringing me money.'"

By partnering with Texas Mutual, Agent Brad Board helps his clients earn dividends.