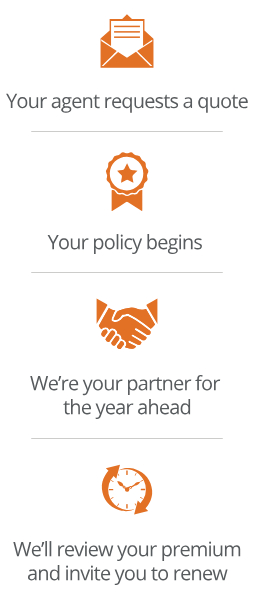

What to expect with your policy

Workers' compensation protects your business even as it grows and changes through the year. Here's how we work with policyholders to provide the right protection all year long:

- Your insurance agent tells us about your business, your payroll and the risk level of the jobs you are paying employees to do, and your company's safety record to get a quote.

- Choose a payment plan that works for you, typically either paid up front or paid on a recurring basis throughout the year.

- If you're in an industry where payroll tends to change a lot, you may submit periodic payroll reports online. This helps you confirm your workforce size and status as it fluctuates.

- It's time to renew! Work with your agent to renew your policy, commit to a safe year ahead and use our free resources to continue keeping costs low.

- At the end of your policy year, we look back at your payroll to confirm your coverage and make premium adjustments. Sometimes we find that policyholders had less payroll than they expected, and sometimes they've had a great year of business and end up with more. Many policyholders have no major change.