October 24, 2023

What you should know about upcoming experience rating changes

As your workers’ compensation partner, we’re committed to helping you stay informed of the latest regulatory updates. The National Council on Compensation Insurance (NCCI), the organization that determines experience modification ratings, is updating its experience modification values for 2024. To help you prepare, we’re sharing a refresher on e-mods, providing more information on the upcoming NCCI changes and more.

Experience modification and e-mods

Experience modification is an important factor used to determine workers’ compensation premium. An experience modification compares an employer’s actual losses against the expected losses for their industry. This process produces an experience modification rate, also known as an experience rating, EMF, mod or e-mod. E-mods are used to adjust a policy’s premium up or down, depending on the number. Although the exact calculation is more complex, you can think of it as a formula:

Most states, including Texas, use NCCI to calculate e-mods. A score of 1.00 represents an average risk and means the company should perform as expected for the industry. If actual losses are less than expected, the e-mod will be less than 1.00, sometimes referred to as a credit mod because it lowers premium. Alternatively, actual losses greater than expected generates an e-mod above 1.00, also referred to as a debit mod because it raises premium.

Actual losses are divided into primary and excess losses, called a split rate.

- Primary losses are generally assumed to be within an employer’s control and enter the experience rating formula at their full value.

- Excess losses are determined by blending the employer’s actual losses with industrywide expected losses.

Industrywide expected losses are likewise determined by applying a factor (called a D-ratio) to divide expected losses into primary and excess expected losses. Texas places a maximum single loss value to limit variances in e-mods.

Upcoming changes

NCCI filed Item E-1409 (716 KB PDF) with the Texas Department of Insurance (TDI) on October 18, 2022, proposing changes to underlying components of the experience rating plan. The purpose of the filing was to reduce the impact of large outlier claims, improve credibility and result in more accurate e-mods.

On October 6, 2023, TDI approved the filing for all policies with effective dates beginning July 1, 2024. The most visible changes for Texas are:

- The primary/excess loss split point value for Texas will change from $18,500 to $16,500. By reducing the split point, the e-mod formula will rely more on industry data and less on employer data. This means the range of credits and debits should be reduced, bringing many employer’s e-mods closer to 1.00.

- The D-ratio will be adjusted so that the average e-mod for all Texas employers will remain at 0.96. In other words, the premium impact for individual policyholders will change, but the expected premium of all experience rated employers will remain unchanged.

- The state per claim accident limitation (SAL), or the maximum dollar amount of a claim included in the modification, will reduce from $255,000 to about $100,000. This means companies with very large losses will benefit, while those without large losses will not benefit as much as they do currently.

To learn more about these changes, explore NCCI’s resources including FAQs, fact sheets and more.

How this could affect e-mods

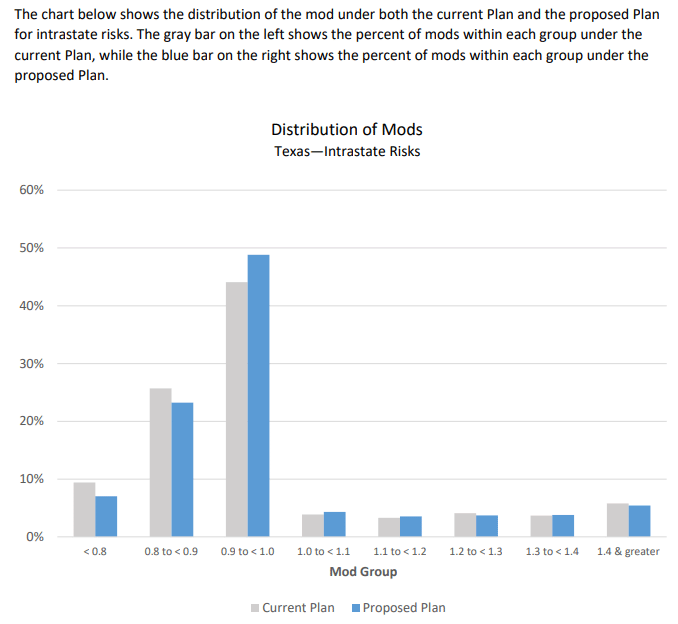

In Item E-1409’s filing, the Informational Exhibit 3 for Texas (612 KB PDF) section indicates that there will be more increases to e-mods than decreases, mostly for rates that are currently below 0.90. Most policyholders will continue to have credit e-mods. The following tables taken from the filing report illustrate what NCCI expects for intrastate rated risks.

|

E-mod difference |

Percent of risks |

|---|---|

|

Decreases more than 5 points |

3.8% |

|

Decreases less than 5 points |

9.1% |

|

Unchanged |

17.0% |

|

Increases less than 5 points |

66.8% |

|

Increases more than 5 points |

3.3% |

If you have questions about e-mods, these upcoming changes or a specific policy, please contact your Texas Mutual underwriter.